Market Recap: Petroleum Distribution Excess Liability

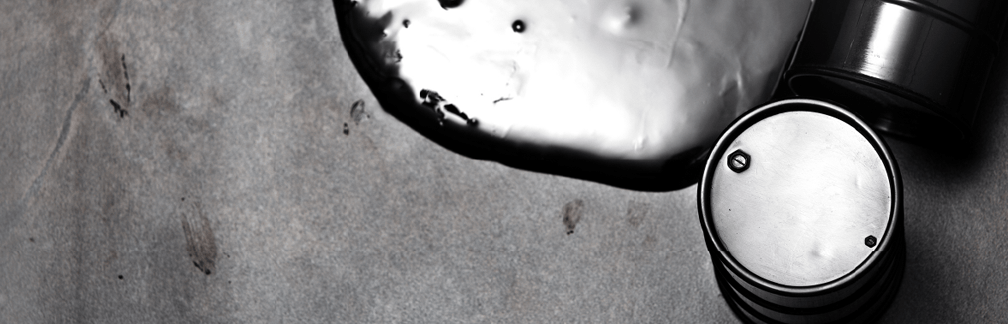

The petroleum distribution excess liability insurance market has been hard for the last few years, albeit it has softened somewhat this year as compared to 2021. Social inflation – fueled by nuclear verdicts, litigation funding, pro-plaintiff, anti-corporation jury sentiment, and tort reform rollbacks – is driving up trucking insurance claims costs for the commercial trucking industry.

For example, litigation settlements have skyrocketed, resulting in an increasing number of nuclear verdicts – jury awards exceeding $10 million. According to recent loss data from Advisen, the median cost of a nuclear verdict increased by 35% between 2015 and 2020, from $20 million to $27 million.

The current litigation landscape and excessive claims costs have caused insurers to raise rates and limit capacity for commercial trucking insurance, including petroleum distribution. “Renewal rate increases are generally running in the 10% to 15% range,” said Jack Kramer, Founder, and CEO of Northeast National Brokerage, LLC, a Lloyd’s Coverholder, and MGA, an affiliated company of Integrated Specialty Coverages (ISC). “Carriers across the board continue to limit Excess Liability capacity, with towers that a couple of years ago might have been completed with one or two carriers now frequently requiring three or more insurers to obtain the necessary limits.”

Auto Liability claims involving trucking insurance and the petroleum distribution sector, Jack explained, are typically tied to bodily injury from motor vehicle accidents involving collisions with private passenger autos, bicyclists, and pedestrians. Property Damage Liability claims typically are due to vehicle overturns which lead to fuel spills. “On the General Liability side, the most common claims come from an explosion at a home or business where propane had been delivered,” Jack noted.

Find a Home for Excess Liability with Northeast National Brokerage

Northeast National Brokerage provides insureds with A-rated Excess Liability insurance with limits of up to $5 million through our in-house underwriting authority with Lloyd’s. In addition, our access to top-tier domestic carriers enables us to build as many additional liability limits as a client requires.

Northeast National Brokerage’s risk appetite includes gasoline, propane, diesel, heating oil, C-stores, marine fuel, aviation fuel, lubricants, bulk plans, crude/water hauling, and haul-for-hire. Coverage is available nationwide.

The Excess Liability policy attaches on a lead excess basis above the primary coverage or in an excess position, attaching over other carriers’ Excess policies. Key coverages include follow-form provisions for pollution, misdelivery, and failure to supply. MC-90 Form E and BMC-91X Form E filings are done in-house as needed.

Insurance agents gain the benefit of Northeast National Brokerage’s underwriting discipline industry knowledge in insuring the petroleum distribution sector, along with ISC’s data science and data engineering capabilities. You will receive a fast turnaround for quotes and a competitive commission structure for commercial trucking insurance. Send submissions to PetroleumExcessSubmissions@northeastnational.com.